Uncertainty Is the New Normal

India’s stock markets, once buoyed by strong post-COVID recovery, are currently grappling with increased volatility. In FY2024-25, the Nifty 50 and Sensex have shown choppy trends, with VIX (Volatility Index) spiking by over 25% in March 2025 alone, indicating rising investor fear. Add to this, global macroeconomic uncertainty, unpredictable monsoon patterns, and a highly anticipated General Election, and you have a recipe for serious market stress.

But here’s the twist: while traditional strategies are getting whipsawed, Quantitative Investment Models (Quant) are proving to be effective in navigating and even capitalizing on this turbulence.

Market Fluctuations in India: Key Risk Drivers

Let’s look at a few facts that underscore the current climate:

- Foreign Institutional Investors (FIIs) withdrew ₹28,242 crore in March 2025, marking the highest monthly outflow in over a year.

- Inflation (CPI) in India rose to 5.3% in February 2025, driven by food and fuel prices, causing uncertainty in rate-cut timelines.

- RBI has paused rate cuts amid external inflationary pressures, keeping the repo rate at 6.5%, affecting borrowing costs and market sentiment.

- The upcoming Lok Sabha Elections (April–May 2025) are influencing sector-specific bets, especially in infra, banking, and PSU stocks.

In this volatile climate, reactive or emotion-driven investing can cause significant capital erosion. Enter Quant.

What is Quant Investing — and Why Now?

Quantitative Investing uses algorithms, mathematical models, and statistical techniques to make data-backed investment decisions. Unlike discretionary strategies that rely on market intuition or news events, quant models operate systematically, based on predefined rules.

Key elements include:

- Pattern recognition across historical data

- Factor-based investing (momentum, value, volatility)

- Sentiment analysis using AI/ML

- Real-time risk management and dynamic rebalancing

How Quant Helps Mitigate Risk During Market Turbulence

1. Dynamic Risk Management with Real-Time Data

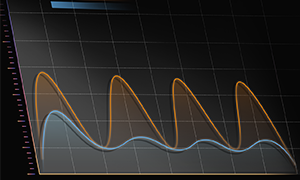

Quant models can analyze millions of data points per second, enabling real-time adjustment to portfolios as volatility increases.

For example: A quant fund might reduce exposure to mid-cap stocks when the India VIX crosses 20, shifting allocations to defensive sectors like FMCG or healthcare.

2. Smart Diversification Using Factor-Based Investing

Rather than diversifying across traditional asset classes alone, quant models analyze risk factors.

A study by NSE on factor investing in India showed that multi-factor strategies (combining momentum, value, quality) outperformed Nifty 50 by 3-5% CAGR over a 10-year period with lower drawdowns.

3. Volatility Hedging Through Derivatives

Quantitative strategies incorporate options and derivatives to protect downside.

For instance: A quant-driven long-short model might hold long positions in large-cap banking stocks while shorting weaker PSU stocks using futures — balancing exposure and reducing tail risk.

4. Sentiment and Alternative Data Analysis

Advanced quant models scan social media, earnings transcripts, news sentiment, and even satellite data to gauge market mood.

Example: During the Adani Group volatility in early 2023, several quant systems detected negative sentiment and exited positions days before the stock collapsed.

Quant Use Cases in India

- Family Offices & UHNI

Customized quant portfolios can help preserve and grow wealth, even in uncertain cycles, by avoiding overexposure to emotion-driven bets.

- Institutional Investors

Quant tools help with compliance-driven allocation, capital preservation, and alpha generation over benchmark indices.

- Retail Investors via Robo-Advisors

Platforms like Smallcase, Zerodha, and Groww are integrating quant logic into thematic portfolios, offering data-backed investments accessible to retail participants.

Real-World Example: Quant Beats Volatility

Performance Snapshot : During the COVID crash (March 2020), while the Nifty 50 dropped by 38% from peak to trough, quant models focused on low-volatility and quality factors dropped only 15–20%, with faster recovery post-lockdown.

In 2023–24, India-focused quant funds such as DSP Quant Fund and ICICI Prudential Quant Fund outperformed the category average with 3-year CAGR returns of 21–23% compared to the large-cap average of 16–18%.

Conclusion: Future-Ready Investing Needs Quant Today

In India’s current economic climate, marked by both opportunity and risk, Quantitative Investing is not just a defensive strategy — it’s an intelligent evolution of portfolio management. As data becomes more accessible and markets more connected, the ability to process, analyze, and act on information faster than the rest will define the winners.

If you’re a serious investor — individual, institutional, or family office — it’s time to integrate Quant into your investment DNA.

Looking for a Quant Edge?

At Barterminds, we specialize in building intelligent, AI-powered Quant models that align with your goals — be it capital preservation, growth, or diversification across sectors and geographies. Connect with us to explore our custom-built data strategies.

Collaborate with us and turn insights into intelligent action.