Markets move fast. Under Trump, they move even faster—and more erratically. If you’ve been watching the tape during his presidency, you know one thing for sure: logic doesn’t always lead, emotion does. And when markets are emotional, volatility becomes the dominant trend.

But volatility doesn’t mean randomness. Trump operates with intent, even if it’s hard to decipher at first. If we can understand his goals and tactics, we can better anticipate market behavior—and maybe even get ahead of it.

Let’s dig in through three lenses:

1. What Is Trump’s Goal?

To understand Trump’s impact on the market, you have to stop thinking of him as a traditional politician. He’s not. He’s an entrepreneur, a dealmaker, a showman. That distinction matters because it explains why he does what he does.

So what’s his goal?

Simple: create leverage and extract value.

Value could mean higher approval ratings, more favorable trade terms, or even a booming stock market (because he sees it as a scoreboard of success). He views the U.S. economy like a business and the global stage like a never-ending negotiation.

In that framework:

- Tariffs aren’t policy—they’re leverage.

- Tweets aren’t noise—they’re opening bids.

- Contradictions aren’t mistakes—they’re strategic misdirection.

Trump’s goal is profit, power, and positioning. But the way he pursues it can be chaotic. That’s where most traders get thrown off. Because while his goal may be consistent, his tactics are anything but.

2. What Is Trump’s Tactic?

Trump doesn’t play by conventional rules. His negotiation style is rooted in chaos, disruption, and emotional pressure. Whether it’s dealing with China, the Fed, or NATO—he applies the same core techniques again and again.

Let’s break down Trump’s 3 key negotiation tactics, drawn straight from The Art of the Deal and applied in full force on the global stage:

1. Flip-Flopping – Control through confusion

Trump frequently reverses course: one day praising a country, the next threatening sanctions. One week it’s a tariff hike, the next it’s a 90-day delay.

Purpose:

-

- Keep opponents guessing.

- Prevent market participants from anchoring expectations.

- Create enough uncertainty that others make emotional, defensive decisions.

Effect on markets:

Traders get whipsawed. Positioning becomes harder. Short-term volatility spikes. Most investors pull back—which ironically gives more power to those who understand the pattern.

2. Exaggerated Threats – Drive fear and urgency

Think 100% tariffs, leaving NATO, buying Greenland. None of these were ever likely to happen—but they sounded real enough to provoke reactions.

Purpose:

-

- Shock markets and governments into action.

- Disrupt normal negotiation rhythms.

- Anchor the conversation so that any eventual deal looks like a “compromise.”

Effect on markets:

Fear rises. Risk-off trades dominate. Bonds rally, stocks fall—until the threat is walked back, and the cycle repeats.

3. Broken Promises – Resetting the game

Deals are announced… and then reversed. Agreements are made… and then re-negotiated. It’s not accidental. It’s leverage.

Purpose:

-

- Keep control of the narrative.

- Regain power if the deal starts to look weak.

- Force counterparties to accept worse terms later out of fatigue.

Effect on markets:

Expectations get constantly realigned. Rally turns to sell-off, sell-off turns to rally—creating massive uncertainty.

3. How to Spot a Market Breakout: From Blue Zone to Green Light

Now let’s turn all this into actionable trading insight.

Right now, we’re in what I call the “blue zone”—a market caught in a loop of uncertainty. Volatility is present, but no clear direction. Sideways chop, fast reversals, and overreaction to headlines.

So when do we break out of the blue zone and enter a real bull phase?

Watch for these breakout catalysts:

1. Trump signs actual deals (not just tweets them)

If we see real, ratified agreements with non-China partners—think Europe, Japan, Canada—that’s a signal. It shows he’s ready to stabilize and call a win.

2. The Fed starts cutting rates aggressively

Right now, Powell is playing it safe—”data dependent.” But if the market forces his hand (or Trump does), and the Fed starts slashing rates or doing surprise cuts, that’s a green light.

3. QE or coordinated fiscal/monetary stimulus

If the Fed and Treasury signal fresh liquidity injections (rate cuts + QE + fiscal policy), the floor gets stronger. Risk assets will respond fast.

Red Zone Warning: Watch the Bond Market

Here’s the key wild card: the bond market.

Trump may tolerate market pain—but not if the bond market breaks. Spiking yields, falling credit quality, or signs of recession could trigger aggressive action from him to force Powell’s hand.

That means:

- More threats

- More pressure

- Possibly even blaming the Fed for “sabotaging” the economy

If bonds are bleeding, Trump gets louder. If bonds stabilize, he might pause. It’s his pain threshold.

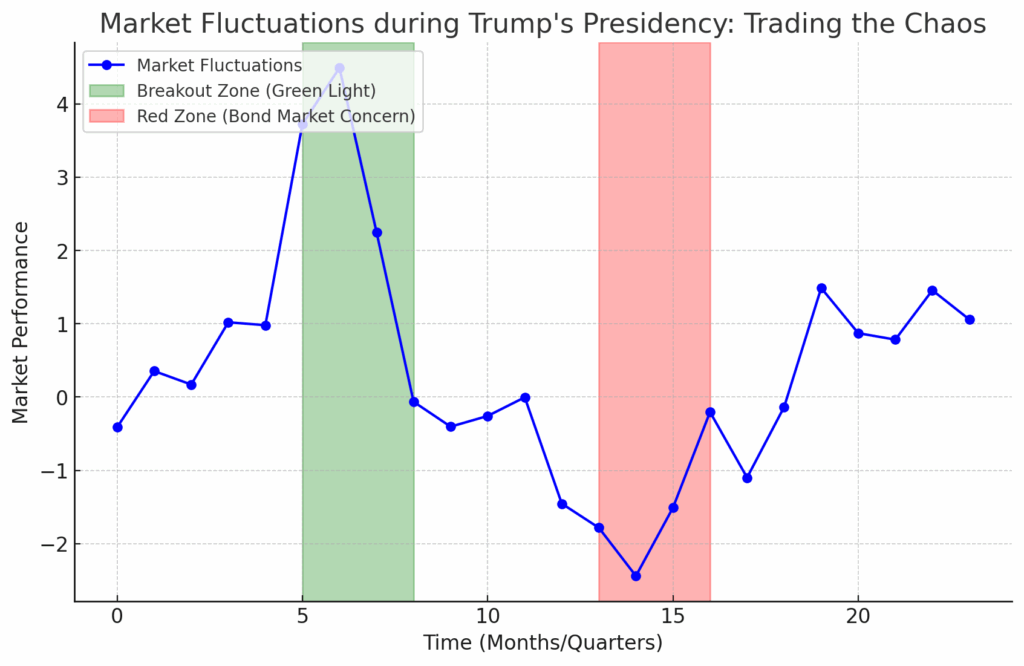

Here’s a graph representing market fluctuations during Trump’s presidency, based on the principles from the Quant Playbook:

- Green Light (Breakout Zone): The market stabilizes and moves positively when Trump signs actual deals, such as with non-China partners (e.g., Europe, Japan).

- Red Zone (Bond Market Concern): A warning sign when the bond market shows signs of stress, triggering a response from Trump or the Fed.

- Market Fluctuations: The chaotic swings due to Trump’s negotiation tactics like flip-flopping, exaggerated threats, and broken promises, leading to emotional market reactions.

Final Thoughts: Master the Chaos, Don’t Get Pulled Into It

Trump’s market strategy is emotional warfare. It’s unpredictable by design. That’s why you can’t trade it like a traditional cycle.

But if you understand the underlying logic—leverage, misdirection, control—you can navigate it with a quant mindset.

- Ignore the noise.

- Track the patterns.

- Watch the signals (not the tweets).

Until one of the breakout catalysts hit, expect more chop. The blue zone will hold. But stay sharp—because when it moves, it’s going to move fast.

Stay data-driven. Stay calm. Trade smart. Collaborate with us to turn volatility into opportunity